Special Tax Lists

With Special Tax Lists, you can apply a different tax/VAT rate to specific products.

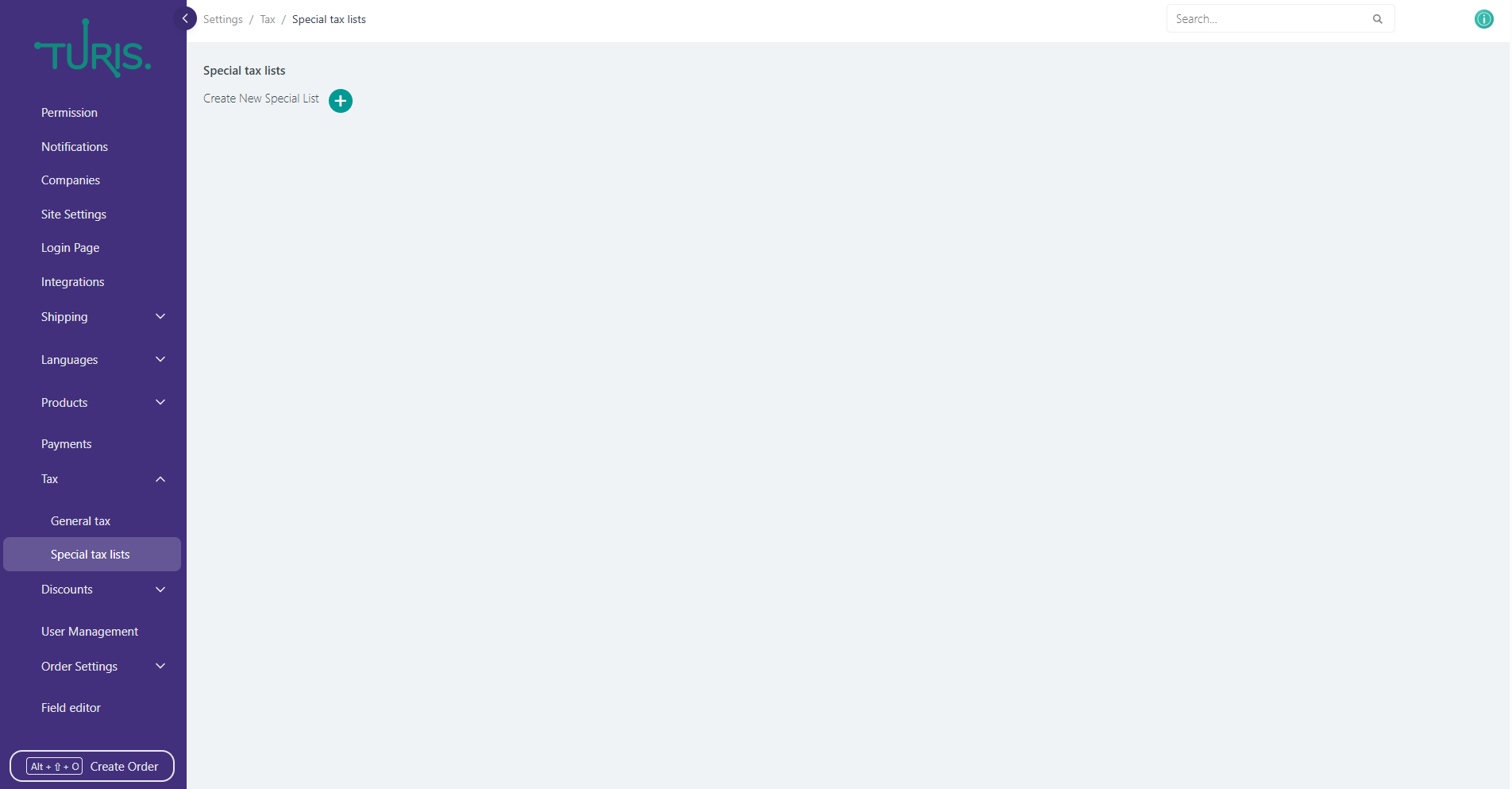

How to Find Special Tax Lists

To locate Special Tax Lists, navigate to Settings > Tax > Special Tax Lists.

You will now see a screen that looks like this:

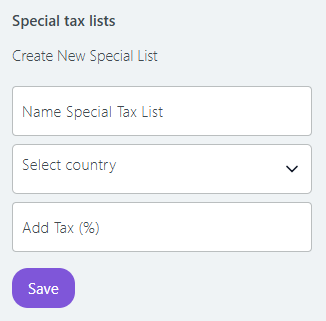

Creating a Special Tax List

To create a new Special Tax List, click the green plus (+) button.

When you click the green plus (+) button, new fields will appear on your screen.

Simply fill out these fields with the relevant information based on the tax rate you want to apply. Ensure the correct tax percentage, country, and list name are entered.

Once completed, click Save.

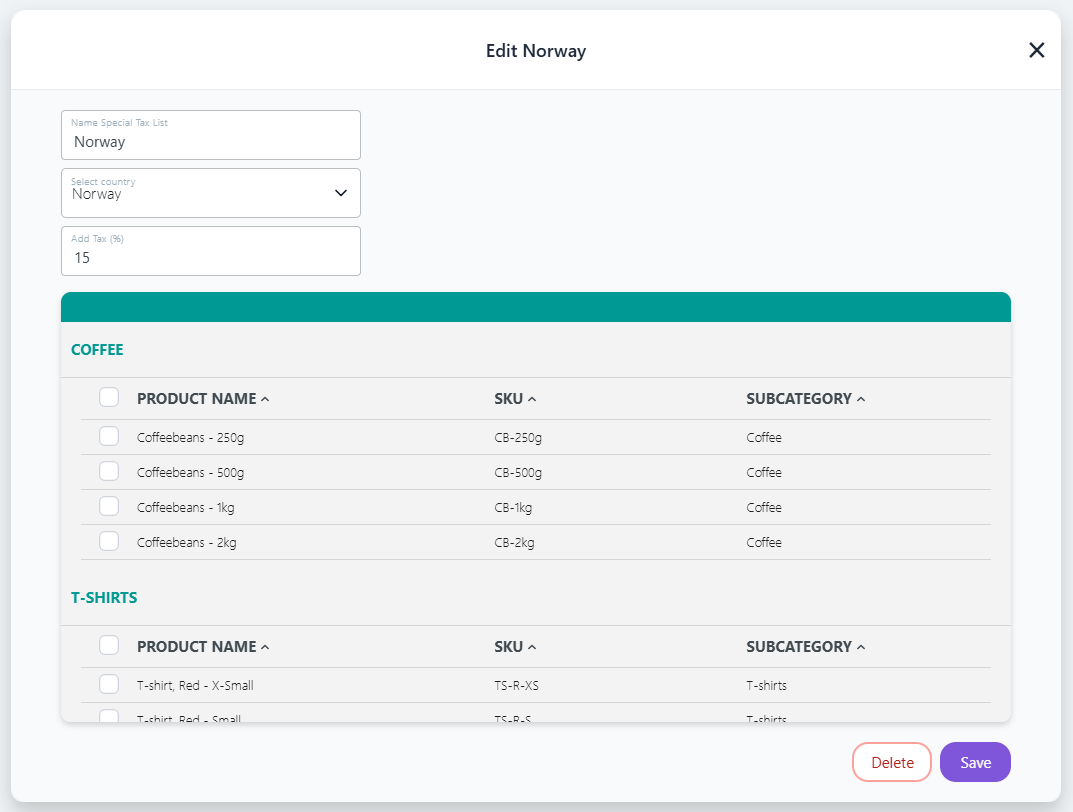

Assigning Products to the Special Tax List

After saving, your screen will now display the new Special Tax List you have created. To assign products to this list, click on the tax list (which is underlined).

A pop-up window will appear, showing the list name, country, and tax percentage, along with a complete list of your products.

Go through the product list and tick the checkboxes for the products that should be assigned to this new special tax rate.

Once all relevant products are selected, click Save.

How Special Tax Lists Work

When a retailer logs in and places an order for these selected products, the system will automatically calculate the specified tax/VAT rate instead of the default rate.

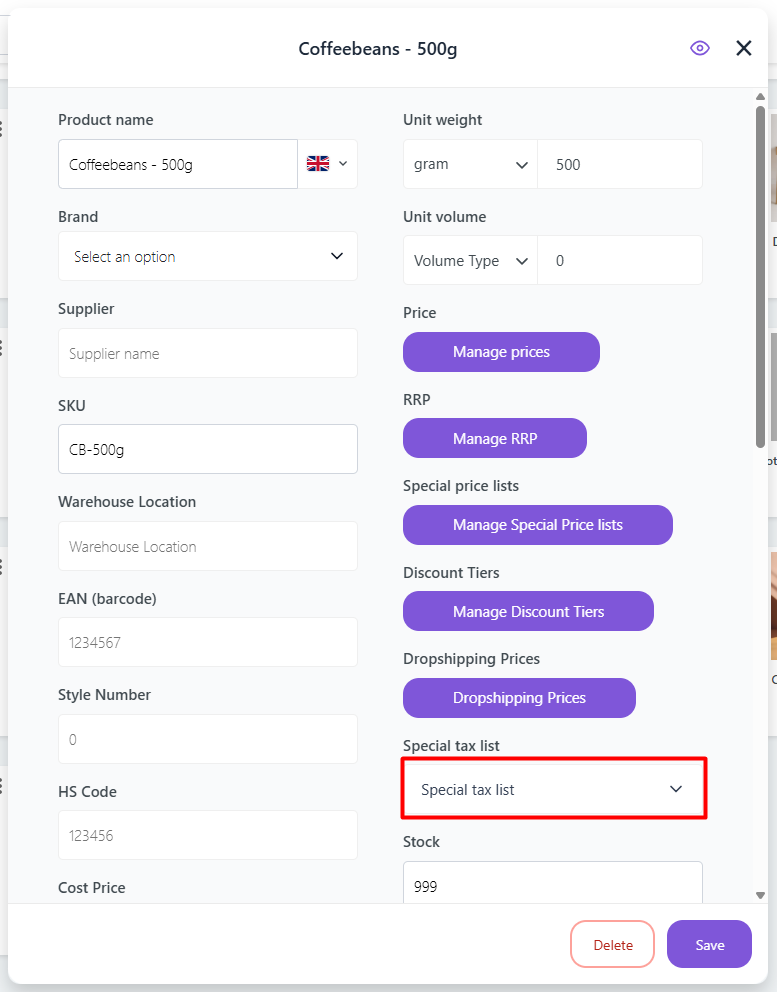

Additionally, when creating new products, you can assign them to a Special Tax List directly by selecting the appropriate option in the Special Tax Lists field.